ALB Limited 25.05.2022

How to Use a Moving Average to Buy Stocks

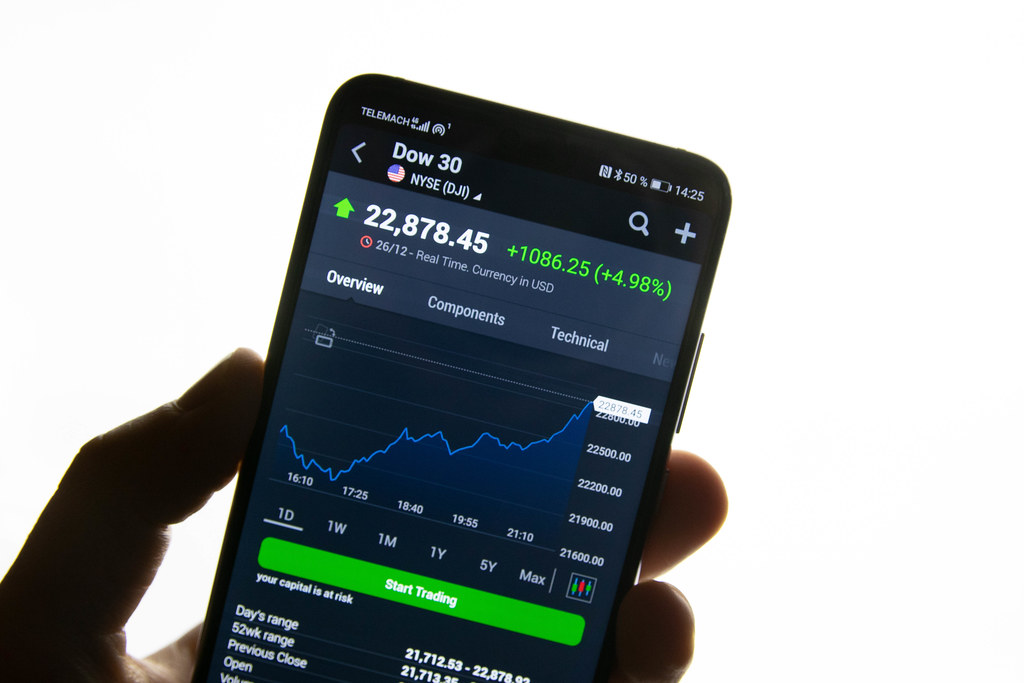

Have you ever wondered how to buy stocks with a moving average? In this blog post, we are going to show you how to use a moving average to buy stocks. Specifically, we will be using the 200-day simple moving average. The 200-day simple moving average is one of the most popular indicators used by traders. It is used to measure the long-term trend of a security. By using a moving average crossover trading system, you can increase your odds of making money in the stock market. Let's take a closer look at how this works.Moving averages are one of the oldest and most popular technical indicators used by traders. A moving average is simply an arithmetic mean of a security's price over a given period of time. There are many different types of moving averages, but the most common type is the simple moving average (SMA). The SMA calculation takes all past prices and weights them equally in forming the average price for that time period. So, if today's closing price was $100 and yesterday's closing price was $50, then yesterday's price would be weighted twice as much as today's price when calculating the SMA."

A moving average is a technical indicator that can be used to identify the direction of a trend in the market. Moving averages are based on past prices and can be used to predict future price movements.

There are different types of moving averages, but the most common is the simple moving average (SMA). The SMA is calculated by taking the average of a security's price over a certain period of time. For example, if you were looking at a 10-day SMA, you would add up the closing prices for the last 10 days and divide by 10.

The longer the time period used to calculate the SMA, the smoother it will be. A shorter time period will result in a more volatile moving average.

Moving averages can be used to identify the direction of a trend, as well as support and resistance levels. When the price is above the moving average, it is considered to be in an uptrend. Conversely, when the price is below the moving average, it is considered to be in a downtrend.

Moving averages can also be used to generate buy and sell signals. A buy signal occurs when the price crosses above the moving average. This indicates that the trend is reversing and prices are beginning to move higher. A sell signal occurs when the price crosses below the moving average. This indicates that prices are falling and a potential reversal is underway.

It's important to note that moving averages are lagging indicators, which means they will not predict future price movements. However, they can be used to confirm trends that are already underway.

When using moving averages to trade, it's important to use other technical indicators to generate signals. For example, you could combine a moving average with support and resistance levels or Fibonacci retracements. This will help you confirm the signal and increase your chances of success.

What is the best way to use the moving average?

Forex traders use moving averages for different purposes. Some use them as their primary analytical tool, while others use them as a confirmation indicator. Moving averages can be used to identify the direction of the trend or define potential support and resistance levels. They can also be used to generate buy and sell signals.There are many different types of moving averages, but the most common are the simple moving average (SMA) and the exponential moving average (EMA). The SMA is calculated by adding up the closing prices of a currency pair over a certain period of time and then dividing that number by the total number of periods. The EMA is similar, but it gives more weight to recent prices.

Moving averages can be used in Forex trading in a number of ways. Some traders use them to identify the direction of the trend, while others use them to generate buy and sell signals. Moving averages can also be used to define support and resistance levels.

Here are some tips on how to use moving averages in Forex trading:

Use multiple moving averages to identify the direction of the trend. A good starting point is to use a 10-day SMA and a 20-day EMA. If the 10-day SMA is above the 20-day EMA, it indicates that the trend is up. Conversely, if the 10-day SMA is below the 20-day EMA, it indicates that the trend is down.

Use moving averages to generate buy and sell signals. A common strategy is to buy when the currency pair crosses above the 200-day EMA and to sell when it crosses below the 200-day EMA.

Use moving averages to define support and resistance levels. A common way to do this is to use the 10-day SMA as support in an uptrend and the 20-day SMA as resistance. In a downtrend, the 10-day SMA can be used as resistance and the 20-day SMA can be used as support.

Moving averages are a versatile tool that can be used in a number of different ways. Experiment with different settings and timeframes to see what works best for you.