Random Reinforcement Why Most Traders Fail

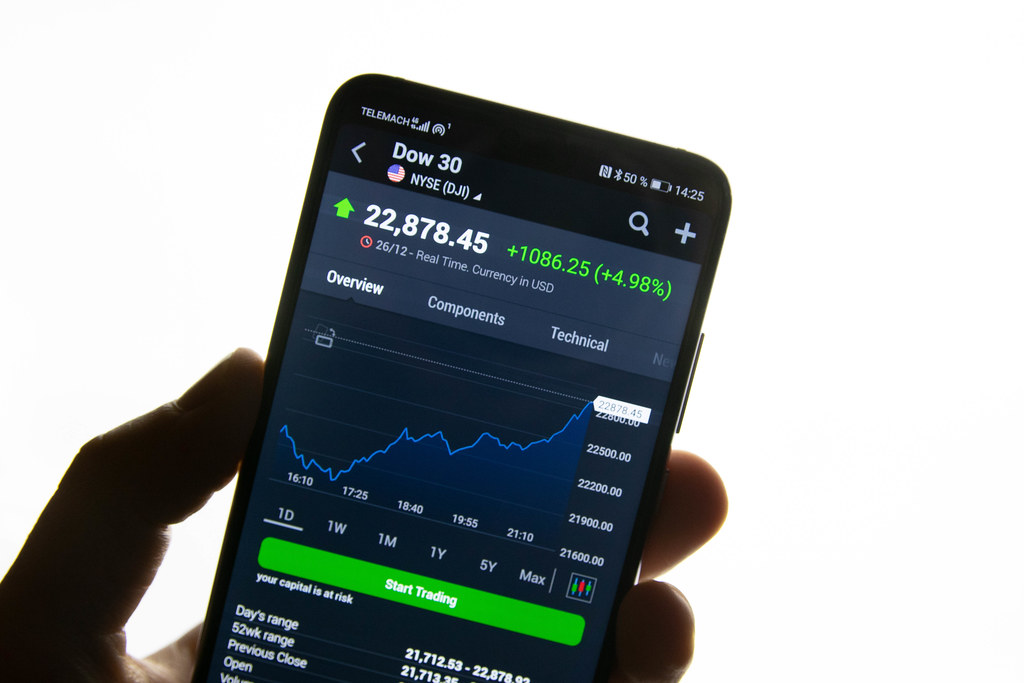

It's no secret that the vast majority of traders lose money. A recent study by the University of California found that only about 14% of traders can profit from trading currency pairs. So what's behind this dismal success rate? And more importantly, how can you avoid becoming one of the losers? One possible explanation is something known as "random reinforcement."

When you're first starting in Forex trading, it's easy to get caught up in the excitement of making a few successful trades. However, this can be misleading, because, for every successful trade you make, there are likely to be many more that lose money. Over time, these losses can add up to substantial amounts.

The problem is that when your losses exceed your wins (as is often the case for new traders), you're reinforcing a losing behavior. That's because each loss reinforces the belief that trading is a risky proposition, and that it's only possible to make money by taking big risks. As a result, traders often end up taking even bigger risks in an attempt to make up for their losses, which can lead to even more losses.

The cycle of loss and reinforcement can be difficult to break, but it's important to remember that Forex trading is not a gamble. With proper risk management and a solid trading strategy, it is possible to make consistent profits from currency trading. If you're suffering from random reinforcement, the best thing you can do is take a step back and re-evaluate your approach to Forex trading. Only by doing this will you be able to put yourself on the path to success.

Random Reinforcement

We've all heard the statistic that 90% of traders lose money over the long term. In reality, recent research by the University of California found that just 14% of traders can profit from trading currency pairs. So what's behind this dismal success rate? And more significantly, how can you prevent yourself from being one of the losers? One possible answer is "random reinforcement."

When you're first starting in Forex trading, it's easy to get caught up in the excitement of making a few successful trades. However, this can be misleading, because, for every successful trade you make, there are likely to be many more that lose money. Over time, these losses can add up to substantial amounts.

The problem is that when your losses exceed your wins (as is often the case for new traders), you're reinforcing a losing behavior. That's because each loss reinforces the belief that trading is a risky proposition, and that it's only possible to make money by taking big risks. As a result, traders often end up taking even bigger risks in an attempt to make up for their losses, which can lead to even more losses.

The cycle of loss and reinforcement can be difficult to break, but it's important to remember that Forex trading is not a gamble. With proper risk management and a solid trading strategy, it is possible to make consistent profits from currency trading. If you're suffering from random reinforcement, the best thing you can do is take a step back and re-evaluate your approach to Forex trading.

10 Biggest Reasons Why Traders Fail In Forex

1. Lack of discipline

2. Over-trading

3. Not using stop losses

4. Poor money management

5. Revenge trading

6. Falling for scams

7. Trying to predict the market

8. Sticking to one strategy

9. Not diversifying

10. Giving up too soon

If you want to be a successful forex trader, you need to avoid making the same mistakes that others have made before you. These are some of the biggest reasons why traders fail in forex. By avoiding them, you increase your chances of success.

Lack of discipline is one of the most common reasons why traders fail. They get too emotionally involved in their trades and let their emotions dictate their decisions. This often leads to impulsive decisions that can result in big losses.

Over-trading is another mistake that many traders make. They take on too many trades and try to make too much money at once. This can lead to them losing focus and making careless mistakes.

Not using stop losses is a big mistake that can cost you dearly. Stop losses are there to protect your capital and limit your losses. Without them, you are at risk of losing all of your money if the market goes against you.

Poor money management is another common mistake that traders make. They don’t have a plan for how to manage their money and this can lead to them making rash decisions with their trading account.

Revenge trading is another mistake that can be very costly. This happens when a trader lets their emotions get the better of them and start trading recklessly in an attempt to make back the money they lost on previous trades.

Falling for scams is another mistake that many traders make. Many unscrupulous people in the forex market are looking to take advantage of gullible traders. Be very careful who you deal with and make sure you do your research before investing any money.

Trying to predict the market is a futile exercise that can only lead to disappointment. The market is unpredictable and no one can know for sure what it is going to do next. The best you can do is to analyze the market and make informed decisions based on your findings.

Sticking to one strategy is a recipe for disaster. You need to have a flexible approach and be willing to change your strategy as the market conditions change.

Not diversifying is another mistake that many traders make. They put all their eggs in one basket and this leaves them exposed to a lot of risks. It is important to diversify your portfolio so that you are not putting all your eggs in one basket.

Giving up too soon is another mistake that many traders make. They expect to make money overnight and when they don’t, they give up. Trading takes time and patience. You need to be willing to stick it out for the long haul if you want to be successful.

These are some of the biggest reasons why traders fail in forex. By avoiding them, you increase your chances of success.